Sustainable Building Design.

Incorporating sustainable design and construction practices requires hard work, determination, and forward-thinking.

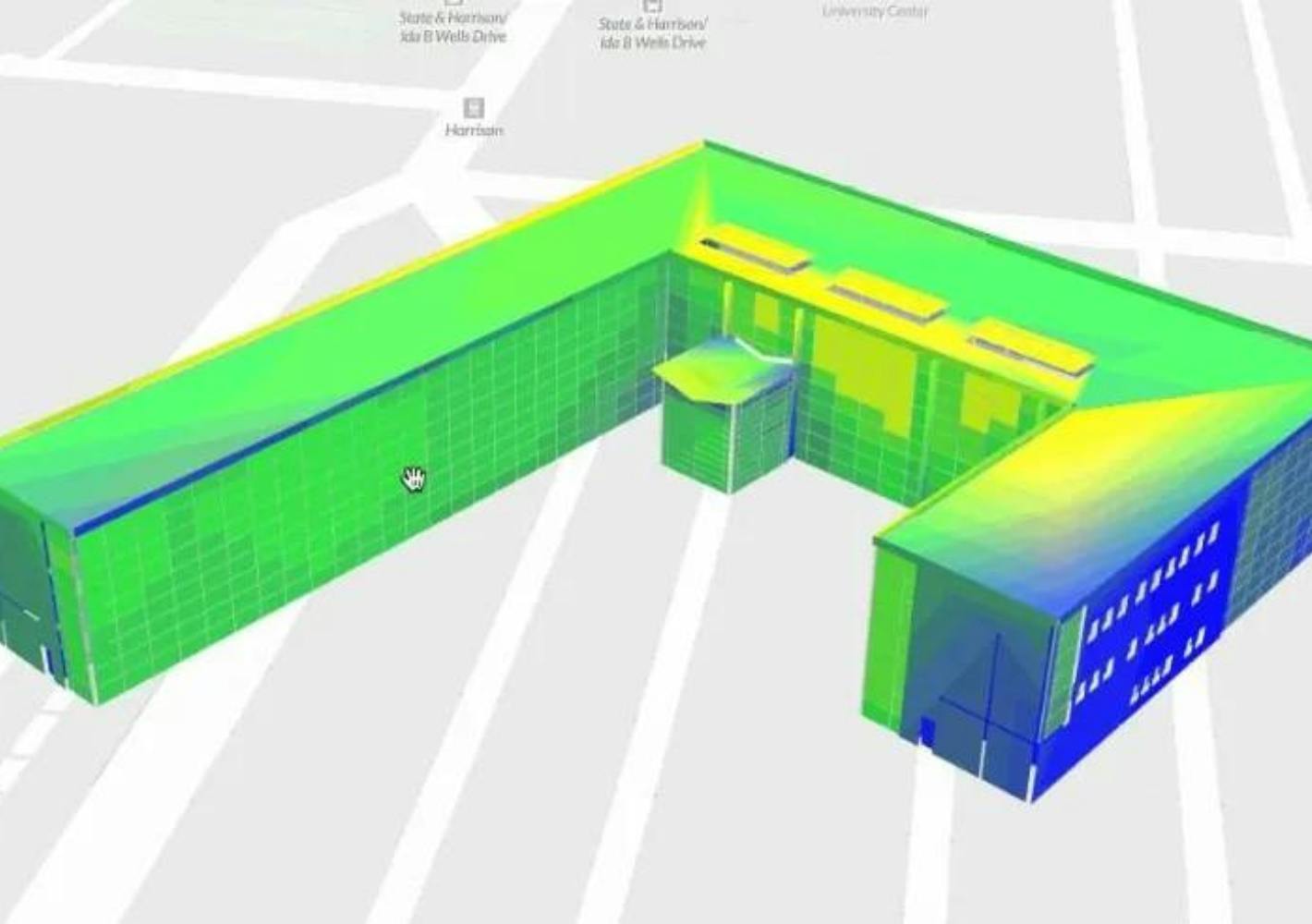

Reducing carbon emissions in the building industry requires effort from all the three stakeholders involved: owners to drive demand, architects to design for the demand, and contractors to execute design in a climate-conscious manner. Buildings account for 40% of those carbon emissions and 76% of electricity use in the United States. If we reduce building energy usage, we join the fight against climate change.